The growth of passive and quantitative investors makes it more difficult than ever for publicly traded companies to understand the motivations of their own shareholder base, identify the most important drivers of their share price and tailor their IR strategy accordingly. The restaurant industry provides an excellent illustration of these challenges.

The growth of passive and quantitative investors makes it more difficult than ever for publicly traded companies to understand the motivations of their own shareholder base, identify the most important drivers of their share price and tailor their IR strategy accordingly. The restaurant industry provides an excellent illustration of these challenges.

A Shifting Landscape for Restaurant Investor Behavior

My background includes over 20 years of investor relations and finance experience in the restaurant industry, and I believe its unique sector dynamics offer a unique illustration of:

- Why macro trends like the rise of “fast money” quantitative traders have made understanding valuation more challenging than ever.

- How these macro trends can take unique, industry-specific forms that require IR professionals to pay careful attention to the nuanced dynamics driving investor behavior in their own corner of the marketplace.

Most IR leaders, executives or experienced investors in the restaurant industry will be familiar with a cluster of core metrics regarded as key performance indicators (KPI’s). A mix of low single-digit same-store sales growth with single-digit or greater unit growth has long been recognized as a recipe for solid profitability, perhaps with a valuation multiple associated with a franchise model, which benefits from lower capital intensity and risk.

Of course, these classic industry metrics may be valued differently depending on the growth stage of the restaurant in question, and whether it is perceived to have an attractive new concept with remaining growth potential. These long-standing performance indicators continue to be important for long-term restaurant investors, but today, IR professionals must also contend with the rise of investors with different motivations.

New Data Sources, New Complexities for Valuation

While the foundational KPIs outlined above remain critical for understanding restaurant valuation, they are only the tip of the iceberg when it comes to widely available restaurant industry datasets. Easy access to, for example, credit card and location based cell phone data, has made the restaurant industry an attractive target for “fast money” quantitative traders seeking to develop proprietary models for forecasting restaurant sales. This shift has led to an environment where a large portion of a company’s valuation may be based on metrics that are unfamiliar to management teams accustomed to working with more traditional key performance indicators. In some cases, this unknown terrain can drive valuation gaps that are difficult for IR officers to explain to management.

For publicly-traded restaurant companies today, some portion of the shareholder base is likely to be trading based on motivations that have very little to do with traditional IR strategy or messaging. Restaurant company management and IR teams do not necessarily need to target this sort of quantitative investor, nor alter their long-term strategy to reflect the preferred valuation metric of these traders. Restaurant companies should still focus on attracting long-term, quality investors who understand the business’s long-term strategy and buy into management’s vision for the company. As ever, business strategy should inform investor relations priorities and not the other way around. But a deeper understanding of your own investors’ motivations is always a critical first step for refining IR strategy, and resources like 13F filings provide limited insight for segments of the shareholder base that turnover every few months, if not weeks.

These challenges are precisely why Arbor Advisory Group has invested heavily in elevated capabilities for helping clients identify the root causes of their current valuation — and tailoring their IR strategy accordingly. Capabilities like factor analysis — which disaggregates the company-specific contribution to valuation from market influence and derives correlations between KPIs and valuation — can be critical for identifying the underlying drivers of a given restaurant’s share price. Quantitative analysis, complemented by human analysis and interpretation, are part of the approach we call IR 2.0.

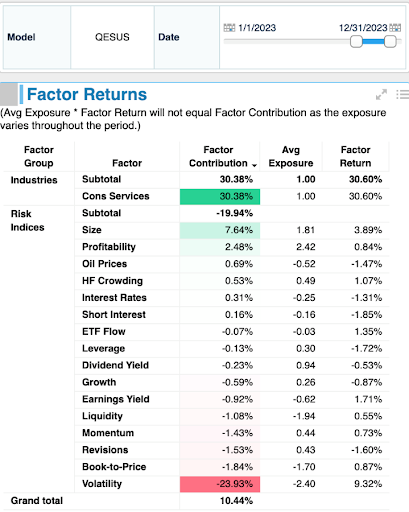

The following example illustrates prototypical insights gleaned from our factor analysis work. In 2023, McDonald’s Corp. (NYSE: MCD) stock returned 15% — but only about a third of this gain was due to stock-specific alpha. The vast majority of these returns were driven by external market factors. As shown below, the stock benefitted mainly from the performance of the Consumer Services sector and its large size. On the downside, MCD was hurt by its lack of volatility (high-volatility stocks outperformed in the period).

Based on our team’s experience working with dozens of clients across the restaurant industry and beyond, a more in-depth approach to analyzing valuation and shareholder composition is instrumental in helping IR professionals and management teams adapt to today’s ever-shifting marketplace.