A performance beauty company was delivering on its long-term strategy, achieving stand-out growth in a lucrative market segment. So why wasn’t this remarkable growth reflected in its share price?

A performance beauty company was delivering on its long-term strategy, achieving stand-out growth in a lucrative market segment. So why wasn’t this remarkable growth reflected in its share price?

They lacked crucial insights needed to communicate their company’s value and strategic direction to their investor base. As part of their engagement with the Arbor Advisory Group, we were able to deliver an in-depth valuation assessment to provide concrete answers for company executives and tailored a custom IR strategy to reach new investors.

The Story: A Successful New Market Entrant with an Innovative Marketing and Distribution Strategy

This exciting, young brand (the Company) had successfully employed a cutting-edge advertising strategy to win double-digit market share just a few years after developing a highly competitive new entrant for a proven, high-revenue cosmetic dermatological market segment. This strategy has proven particularly successful at attracting millennial consumers, a crucial demographic who are adopting related cosmetic products at a rate twice that of older cohorts.

The Company’s operations involve licensing products from R&D companies for distribution through an innovative partnership network including dermatology offices, medical spas and plastic surgery practices. Products are marketed for cosmetic (non-therapeutic) use under a cash-pay model and are not covered by insurance, an approach that allows for co-marketing opportunities with dermatology practices. This synergistic strategy leverages co-branded digital advertising to drive business through partners, which benefit from upselling opportunities.

The Scenario: A High-Growth Company with a Valuation That Lagged the Competition

With another high-potential product launch on the horizon, executives believed that their company had a tremendous growth story to tell investors, yet they were increasingly frustrated that their remarkable performance and potential were not reflected in the Company’s stock price. Senior management was particularly dissatisfied with poor stock performance relative to a specific competitor, and they needed more granular insights into the main factors driving share price and investor sentiment and to understand the best path to earning a more competitive valuation.

The Company’s Investor Relations Officer, a pharmaceutical industry veteran, reached out to Arbor Advisory Group for help diagnosing the root causes of their lagging valuation — and developing actionable insights to address potential gaps.

Our Role: A Deep Dive Valuation Assessment to Pinpoint the Factors Driving Stock Price

As the foundation for a refined investor engagement strategy, Arbor conducted an in-depth analysis of the quantitative factors driving the performance of all companies in this performance beauty company’s peer group.

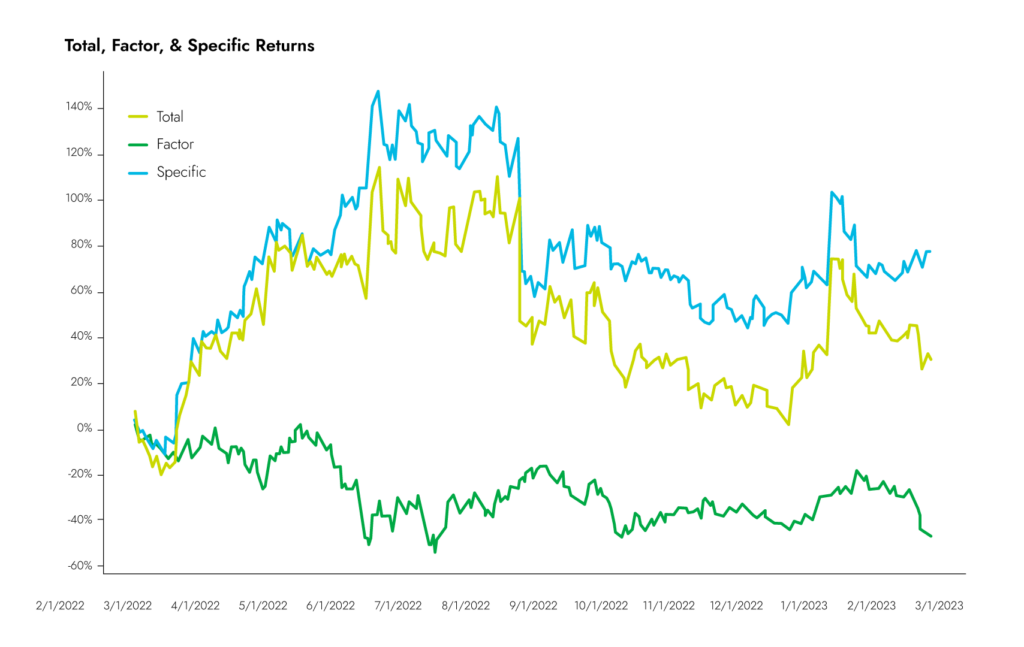

By leveraging proprietary tools, we provided precise quantitative insights into the proportion of share price performance driven by macro-level shifts in the market versus idiosyncratic, company-specific factors. These analytical capabilities offered granular insights into not just which thematic factors were the most salient for price performance, but also how exposed the Company was to each of these factors.

Image courtesy of Anduril Partners. This image shows a factor analysis chart that measures the total, factor and specific returns for the Company over a year’s span, capturing how the market moved, the exposure to movements and its impact on the stock.

In the Company’s case, we discovered that market factors had been an overall drag on stock price, while company-specific factors had helped buoy against negative performance for the broader performance beauty segment. In short, investors were betting on this company but market factors outweighed the tail wind.

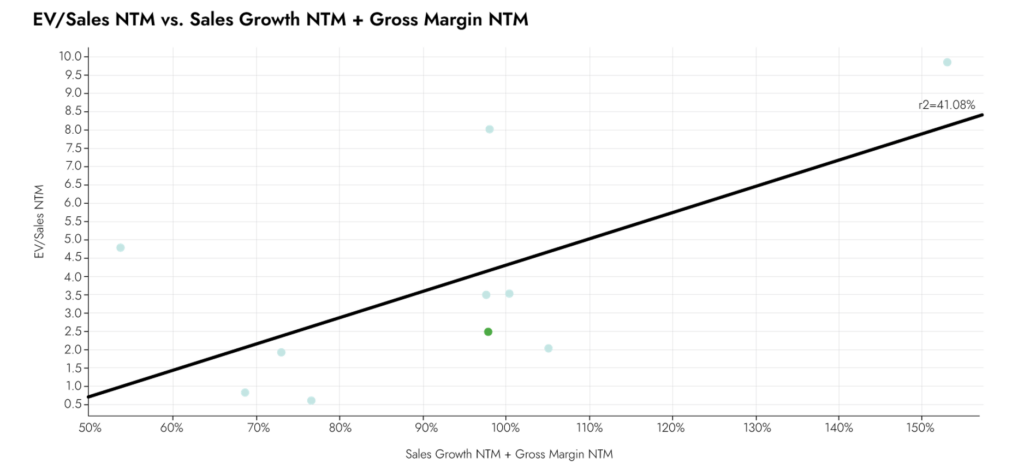

In addition to this factor analysis, we compared company valuation to market competitors using the same metrics commonly employed by institutional investors and analysts. By measuring the correlation of actual market outcomes with various key performance indicators (KPIs), Arbor identified which quantitative factors were driving investor sentiment in this space. For example, we compared the client to peers using the “Rule of 40,” a prototypical metric based on the intuition that a company should offer some combination of strong sales growth or outstanding profitability, ideally with a growth rate and profit margin aggregating to 40% or higher.

Image courtesy of Anduril Partners. This chart is a representation of the Rule of 40. This chart captures the valuation of the Company relative to its sales and profitability.

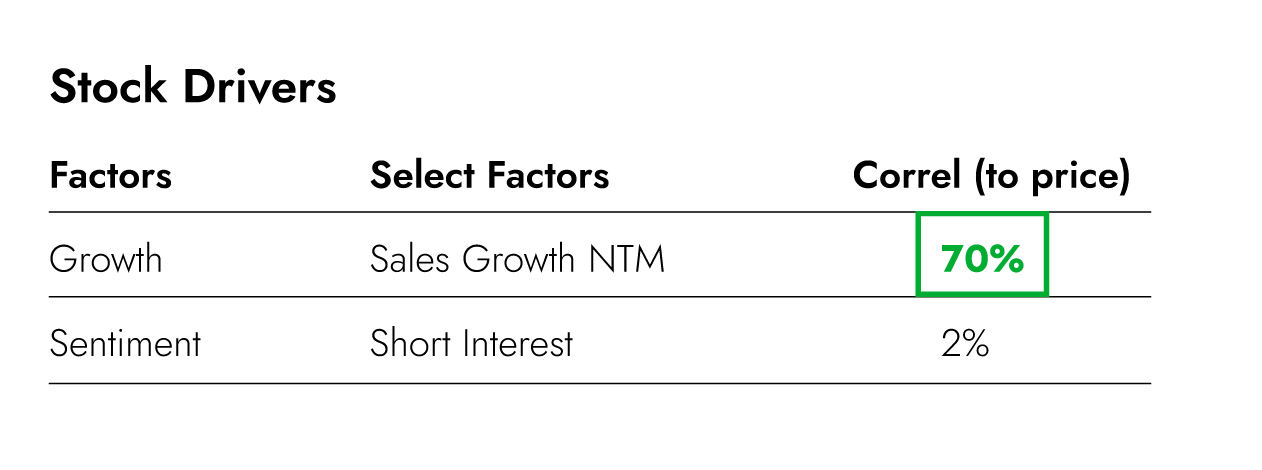

This comparison suggested that the Company was undervalued based on sales and growth, and that investor communications needed to be tailored to emphasize these factors. After further exploration, our valuation analysis successfully pinpointed a metric with an exceptionally high (70%) correlation with the Company’s stock price movement: next twelve-month (NTM) sales growth.

Image courtesy of Anduril Partners. This is another chart from Arbor’s valuation analysis of the Company, which shows the correlation between key performance indicators and stock price.

This level of quantitative insight effectively empowers executives with “valuation X-Ray vision,” allowing them to see the root causes of share price movement with incredible clarity. Essentially, they’re armed with crucial information for shaping the strategic priorities for the IR program.

Our article takes a deeper look at why the right analytics capabilities are crucial for diagnosing valuation gaps in today’s markets.

Arbor supplemented this quantitative foundation with a deep dive into sell-side coverage of the client and its peer companies, as well as a detailed review of cross-ownership and major institutional holdings. Our team further delved into a granular comparison with the Company’s competitor, examining each company’s respective product portfolio, product differentiation, go-to-market strategy and the associated perception of these factors by the investment community.

This phase of research included analysis of data from an investor perception study, in addition to an intensive review of long-range planning, company strategy and the addressable market. Our ultimate goal in this phase was to understand the ins and outs of the Company’s mission, purpose and vision — and the Company’s ability to execute this vision.

Finally, Arbor conducted a comprehensive overview of the IR program.

The Results: A New Approach to an Investor Relations Program Widens Its Aperture to Reach New Investors

Arbor’s initial analysis suggested that a different approach to the IR program had the potential to make a more impactful case to investors, improve valuation compared to peer companies and reach investors in entirely new market segments. The Company had historically focused on biopharmaceutical investors, a highly specialized audience with extensive technological knowledge but limited experience valuing innovative marketing and distribution models.

We recommended that the IR program broaden its scope to reach new consumer goods and beauty investors. This approach generated immediate returns, as the Company was invited to present at a consumer goods conference by a bank that did not provide sell-side research coverage on the Company

Arbor proposed concrete recommendations for optimizing IR strategy and execution. We introduced the Company to new industry analysts, derived a target investor list for proactive marketing and led the development of a more robust long-term planning schedule for investor meetings, conferences, non-deal roadshows and other events (both virtual and physical).

The Company has since expanded its conference participation in biopharma while adding consumer and growth conferences. By strategically planning the entire year in advance, the IR team can ensure the executive team is committed to supporting the IR program and that all analysts can receive important facetime with management. This important planning process enables executives to present to banks’ equity sales forces in advance of conferences and other investor events, empowering them to share a more cohesive company message and promote these events to their buy-side clients.

From 2022 to 2024, the client tripled their total number of investor events, interfacing with nearly 130 new firms on the buy-side in 2023.

Arbor conducted a comprehensive review of all investor-facing communications, collaborating with the Company’s marketing team to maintain a voice aligned with this fun, youthful brand. We developed a refreshed investor relations slide deck, website and video, employing a refreshed messaging strategy that stripped away industry jargon to focus on the specific factors that drive investor decision-making. This focused approach helped clearly convey the Company’s large addressable market, its outstanding opportunity for growth, its consistent and strong execution and its ability to continue to win market share while simultaneously improving cash flow and profitability.

Featured Result: Fully Branded Investor Day Instills Confidence in Management Team

In 2024, Arbor helped the Company host a best-in-class hybrid Investor Day. The leadership team understood and leveraged the true value of investor events: as an opportunity to showcase a strong management team. As a result, the global leadership team explained their go-to-market strategy in detail, adding context, color and credibility to their growth story. This level of access to key leaders helped solidify confidence in the management team – which is one of the most important considerations that investors take into account when making investment decisions.

The event itself was spectacular and highly branded, from a visually striking entrance area to a full graphic takeover which transformed a blank event space into an immersive experience that brought the brand to life. While it was certainly an investment, the Company got maximum return by pairing it with a customer event, sharing the space and costs with the marketing and sales teams.

The ROI was clear: sell-side coverage was overwhelmingly positive, with several analysts increasing their price targets, and, critically, the Company’s valuation increased significantly in the following days.

We supported the production of this event from concept to execution including strategic storytelling, content creation and storyboarding, rehearsals and day-of Q&A moderation. This Investor Day exemplified the importance – and potential positive results – of strong alignment between investor relations and marketing teams.

Read our article for a deeper look at how modern marketing presents new opportunities for IR teams to engage audiences.

“The work that Arbor has done has been transformative.” – CFO

Since Arbor’s engagement began, the client has not only beaten analyst expectations but earned a raised outlook from Wall Street. Its outstanding growth continues to shine, and with a major new product launch on the horizon, its growth prospects appear bright for years to come.

Five of the Company’s top ten holders have expanded their ownership, with two top ten holders initiating their positions in the past year.

Arbor collects ongoing feedback to gauge the impact of the IR program, and investors have consistently shown their appreciation for this client’s elevated approach to investor relations. In our most recent survey, a panel of investors ranked the Company an almost unheard-of 4.94/5 for execution.

Learn More About IR 2.0

In a modern equity market heavily influenced by algorithmic trading, passive investors and factor-based strategies, understanding company valuation is more challenging than ever before. As this case study illustrates, the right analytical capabilities are critical for diagnosing potential gaps in the IR program, while nuanced qualitative research remains fundamental to understanding the full array of factors influencing market perception.

Developing insights into these factors is vital for implementing an investor relations strategy that communicates a compelling vision for the Company’s value proposition to the broadest possible audience and supports the IR practice needed to sustain the highest possible long-term valuation.

Learn about Arbor’s comprehensive approach to valuation analysis.