For investor relations (IR) departments and senior leadership teams, explaining shifts in stock price is critical for formulating an appropriate response, particularly when market valuations diverge from management’s expectations. But in today’s equity markets, dominated by algorithmic trading, passive investors and index funds, “minding the gap,” is a genuine analytical challenge. In this article, we explain why.

For investor relations (IR) departments and senior leadership teams, explaining shifts in stock price is critical for formulating an appropriate response, particularly when market valuations diverge from management’s expectations. But in today’s equity markets, dominated by algorithmic trading, passive investors and index funds, “minding the gap,” is a genuine analytical challenge. In this article, we explain why.

What Are Valuation Gaps?

In short, a valuation gap refers to a difference between management’s perception of long-term value and the current valuation as expressed by markets. As we explore below, this divergence may be rooted in poor communication with investors, lagging performance relative to quantitative metrics used by investors or broader market factors that are outside of the control of company executives (much less the IR officer).

Of course, businesses have always sought to close potential valuation gaps. Today, however, structural changes in equity markets have made identifying and addressing these gaps more challenging than ever before.

Why Valuation Gaps Are a Greater Challenge Than Ever in Today’s Equity Markets

Over the last ten years, investors’ access to data has proliferated at an unprecedented pace, as have the analytics capabilities necessary to extract actionable insights from this data. Naturally, investors have adopted this technology to create novel strategies, relying on unique valuation metrics that are not often transparent to the market—or, critically, to company executives.

We see evidence for this trend in significant growth in Assets Under Management (AUM) and daily trading volume driven by:

- Algorithmic investing strategies, which execute various pre-programmed trades based upon perceived arbitrage opportunities.

- Factor-based investment strategies, which seek to outperform indexes (or to hedge risks in an investor’s portfolio) by targeting specific factors related to value, financial performance, price movement, sector, volatility and more. Factor-based models may focus on just a handful of factors or cover dozens at a time.

- Passive investment strategies, which seek to match the performance of a given index or market segment. Notably, while a passively managed fund will seek to match a given segment or index’s performance, that doesn’t necessarily mean it will invest in equal weights in all constituent companies.

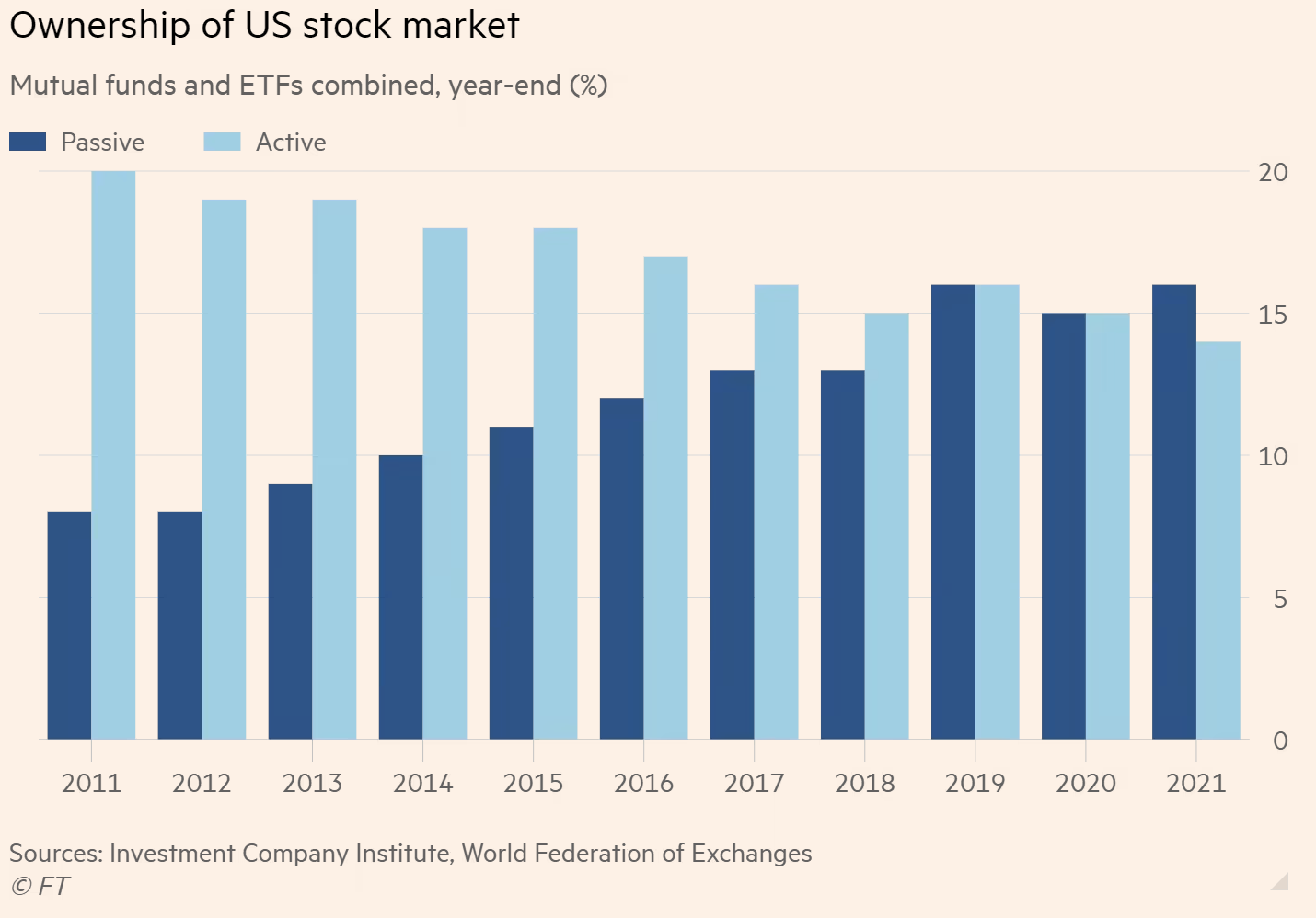

Today, algorithmic and factor-based investment strategies are employed by some of the largest hedge funds and investment banks on earth. Passive investment strategies (including index funds) have eclipsed the market share of actively managed funds, overtaking them in US stock market ownership for the first time in 2022, according to the Financial Times.

Source: Financial Times

Source: Financial Times

The massive growth in trading volume from investing institutions employing these strategies can cause manic changes in short-term share price and valuation. While the stock price may revert to “normal” eventually, executive leadership is often left confused by this sudden volatility. In a report on the astonishing algorithm-fueled volatility in the wake of the COVID crisis, Forbes notes that executives “may have to get used to big, sudden moves in the stock market due to fewer institutions pushing equities to attractive valuations while hedge funds reach unprecedented levels of employing computerized momentum-based strategies.”

Recognizing the impact of these newly dominant investing strategies is critical to correctly diagnosing valuation gaps. But it is also critical to remain sensitive to a longer-term, and often less discussed, root cause of valuation gaps: perceived value that the senior management team believes should be reflected in the share price but isn’t. Common root causes of longer-term divergences between share price and management value perception include:

- Failures to communicate with investors who do not understand management’s proposed long-term value proposition for the company.

- Investors who understand management’s proposed valuation but disagree on the degree of value added.

- Investors who do not believe that the company will achieve projected growth. This lack of confidence may stem from poor management credibility or differences of opinion on the macro market environment.

- Relative valuation challenges, wherein investors simply believe that better opportunities are available elsewhere in the market.

Accurately diagnosing which of these issues are driving a given valuation gap is critical for assessing which valuation factors are controllable, which factors are not and where the investor relations program should be focused. Identifying valuation gaps, however, is rarely a straightforward endeavor.

Why Is Identifying Valuation Gaps So Challenging?

Because the potential underlying drivers of a valuation gap are so multi-faceted, it can be incredibly challenging for IR professionals and management teams to reconcile the difference and explain it to their boards, employees and other stakeholders. Meanwhile, the short-term reactionary effects caused by the massive amount of algorithmic, quantitative and passive-based trading can make analyzing valuation feel like hitting a moving target.

Estimating the intrinsic value of a company is an inherently subjective, nuanced process that relies on making assumptions about discount rates, future revenues and future cash flows to determine a valuation today. Most IR professionals lack the time, resources and expertise to develop intrinsic value models.

Relative valuation compared to peer companies provides a more straightforward method for assessing value, but this approach requires staying on top of constantly changing market and peer dynamics. In this regard, sell-side research often provides valuable clarity. But even the best sell-side research is inherently subjective, targeting a particular mix of buy, sell and hold ratings. Generally, the horizon of sell-side analysis is around twelve months, while the time frame for company management’s proposed valuation may be far longer.

IR professionals are ultimately responsible for distilling these inherently subjective valuation processes into a coherent explanation for management. In doing so, they face the sensitive task of giving an honest voice to investors’ concerns while remaining supportive of business strategy.

How Valuation Gaps Cloud Organizational Decision-Making

IR professionals’ difficulty explaining valuation gaps to executives is only one symptom of a more deep-seated issue: executives simply do not have access to the in-depth analysis needed to identify the fundamental drivers of share price movement. Or, if they do, they have no objective method for measuring and monitoring these drivers over time. This fundamental lack of robust valuation capabilities can lead to bigger problems for the organization:

- Executives who are continually confounded by valuation will expend time, stress and energy searching for answers.

- Limited awareness of the real drivers of long-term valuation gaps can result in reactionary decision-making that is contrary to the long-term best interests of the company.

- Strategic decisions that fail to address the real concerns and valuation metrics of investors can eventually lead to investor skepticism of executive team performance.

- Corporate governance standards recommend that executive compensation is tied to share price performance, and an executive team that finds itself continually surprised by shifts in stock price may become skeptical of the effectiveness of its own IR program. Of course, few executives are likely to complain if the stock is overvalued by the market—which means the IR function may be blamed when valuation recedes to a more realistic long-term level.

In the inherently subjective sphere of long-term valuation, not everything can be quantified. For IR professionals, there will always be a need for delicate conversations with investors, executives and board members alike. But while they may not provide the final word on valuation, factor-based metrics will always provide greater clarity and a more firm footing for IR strategy. Ultimately, deeper valuation insights empower IR officers and executives to recognize the market’s concerns and choose how to address them.

Why Elevated Analytic Capabilities Are Crucial for Diagnosing Valuation Gaps

Given the myriad complexities discussed above, there is no substitute for systemized regression analysis to understand how a company’s share price and valuation is correlated with changes in market “factors” (including both widely-known factors and underappreciated valuation metrics). Robust data-driven insight into what is driving share price performance—and which of those factors the IR/Management teams have some influence over—can help focus time and energy on what really matters (and provide invaluable credibility to management and the board).

The scope of these fundamental valuation insights can be further extended by synthesizing them with a broader analysis of peers, macro-market conditions and any other factors needed to generate a truly comprehensive analysis. There is art and science to this practice. The real challenge is using quantitative indicators to answer the “why” behind the company’s valuation by drawing on investor feedback, conference call questions, meeting questions and other qualitative sources to discern how people are making specific investment decisions.

This granular insight gives both IR professionals and the senior management team a deeper understanding of their share price, a foundation for confident strategic decision-making and the basis for investor communications that are tailored to investors’ front-of-mind concerns. This understanding is critical for maintaining self-awareness of where IR strategy is succeeding, where it may need refinement and how it can be targeted to address any areas where investor confidence is falling.

How can organizations begin to mature their capabilities for identifying and measuring the most important drivers of a potential valuation gap? Based on Arbor’s experience working with a variety of publicly traded companies, IR professionals and executives recognize that enhanced valuation capabilities could dramatically improve the performance of the company’s IR program while helping to refine business strategy. But how can the company get there? Investing in the underlying data, systems and expertise needed to conduct in-depth valuation analyses and explain the results is time and cost-prohibitive for most organizations.

Arbor Advisory Group, in partnership with Anduril Partners, provides our clients with detailed, highly digestible intelligence on how changes in various market factors are impacting their company’s share price. Anduril brings 20+ years of professional portfolio management and data analytics experience to the table. To pinpoint valuation gaps, Anduril employs a number of different analytical approaches, including covariance modeling and other complex statistical work. This same arsenal of capabilities is used by quantitative trading programs to generate KPIs (and increasingly by fundamental-oriented fund managers seeking to understand quantitative trading activity). For example, in the wake of the COVID crisis, companies with high sensitivity to leverage were hit very hard initially. By employing data intelligence, which aggregates similar stock movements across a universe of stocks, we can help pinpoint the degree to which this and other themes are playing out in a specific stock’s price. This allows us to isolate market and company-specific valuation drivers.

Anduril’s breadth of valuation analytics capabilities is an ideal foundation for diagnosing specific valuation-related issues. Looking forward, this intelligence is used to not just better understand valuation, but also identify a proactive approach for tailoring strategy and communication to modern investors’ most salient concerns. Simply identifying the relevant metrics is not enough. Anduril Partners works with Arbor to understand how the organization can respond in terms of concrete operations, corporate structures and reporting lines. The Arbor-Anduril team takes pride in getting into the operational weeds to truly connect the dots between valuation, KPIs and long-term operational excellence.

Arbor synthesizes Anduril’s data intelligence with nuanced, qualitative research on a myriad of factors including market perceptions, competitors, industry trends and key risk factors. With decades of collective experience working in corporate investor relations, investment management and data analytics, we have the expertise needed to help develop a custom-tailored plan for addressing your company’s valuation gaps. Learn more about our valuation services here.

This piece was authored in collaboration with Jon Neitzell. Jon is the founder of Anduril Partners, an investment and advisory firm focused on the application of data-driven processes, and serves as a Technology Advisor for Arbor Advisory Group. Jon has over 20 years of technology and financial services experience as a portfolio manager and chief data officer, and he has served on several boards and in advisory roles.